Tesla (TSLA) will launch its Q1 2025 monetary outcomes right now, Tuesday, April. 22, after the markets shut. As normal, a convention name and Q&A with Tesla’s administration are scheduled after the outcomes.

Right here, we’ll take a look at what the road and retail buyers anticipate for the quarterly outcomes.

Tesla Q1 2025 deliveries and vitality deployment

CEO Elon Musk and his loyal shareholders typically declare that Tesla is now an AI/Robotics firm, however the reality is that the corporate’s automotive enterprise nonetheless drives the overwhelming majority of its monetary efficiency.

Tesla’s income stays tied primarily to the variety of automobiles it delivers.

Earlier this month, Tesla disclosed its Q1 2025 automobile manufacturing and deliveries:

| Manufacturing | Deliveries | Topic to working lease accounting | |

| Mannequin 3/Y | 345,454 | 323,800 | 4% |

| Different Fashions | 17,161 | 12,881 | 7% |

| Whole | 362,615 | 336,681 | 4% |

It was considerably beneath expectations and roughly 50,000 models wanting what Tesla delivered in Q1 2024.

Analysts have been adjusting their income and earnings expectations accordingly because the disclosure a couple of weeks in the past.

Now, Tesla’s vitality storage enterprise can be beginning to make a significant contribution to its monetary efficiency. The corporate disclosed having deployed 10.4 GWh of vitality storage merchandise throughout Q1 2025.

Tesla not discloses photo voltaic deployment info.

Tesla Q1 2025 income

For income, analysts typically have a reasonably good concept of what to anticipate, because of the supply numbers and now the vitality storage deployment information.

Nevertheless, many had been taken unexpectedly by how low Tesla’s deliveries had been this quarter and the automaker provided loads of reductions, which is able to have an effect on the typical sale worth that analysts at the moment are attempting to determine.

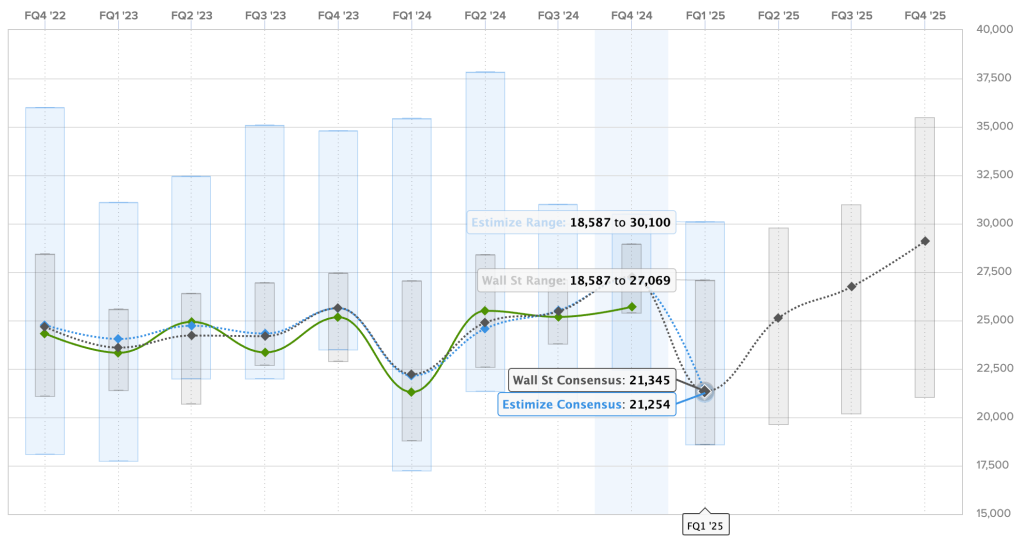

The Wall Road consensus for this quarter is $21.345 billion, and Estimize, the monetary estimate crowdsourcing web site, predicts a barely decrease income of $21.254 billion.

Listed here are the predictions for Tesla’s income over the previous two years, with Estimize predictions in blue, Wall Road consensus in grey, and precise outcomes are in inexperienced:

This is able to be a couple of $1 billion decrease than the identical interval final yr – that means that analysts don’t anticipate Tesla’s elevated vitality storage deployment to compensate for the decrease automobile deliveries.

Tesla Q1 2025 earnings

Tesla claims to constantly attempt for marginal profitability each quarter, because it invests the vast majority of its funds in progress, however its progress has disappeared from its automotive enterprise over the past yr, and its gross margin goes in the identical route.

Analysts are attempting to estimate Tesla’s gross margin with the decrease deliveries to determine its precise earnings per share.

For Q1 2025, the Wall Road consensus is a achieve of $0.41 per share and Estimize’s crowdsourced prediction is just a little decrease at $0.40.

Listed here are the earnings per share over the past two years, the place Estimize predictions are in blue, Wall Road consensus is in grey, and precise outcomes are in inexperienced:

If the estimates are correct, Tesla’s earnings per share can be down from $0.45 throughout the identical interval final yr.

There are a number of issues that Tesla may do right here that might shock buyers with a big earnings beat. Tesla may have acknowledged income from the launch of FSD in China, regardless that the launch was temporary and 95% of the worth of the FSD bundle is unsupervised self-driving, which Tesla has but to ship.

Tesla may have additionally bought extra emission credit. As of the top of final quarter, Tesla was nonetheless sitting on a great quantity, and whereas it claims to promote them when the worth makes essentially the most sense, it’s fairly an opaque market and Tesla may at any time resolve to promote them simply to avoid wasting itself from a foul quarter.

Different expectations for the TSLA shareholder’s letter, analyst name, and particular ‘firm replace’

As we reported yesterday, that is probably going to be a messy earnings report. Musk has been on a propaganda spree currently after Tesla suffered immense model injury and declining inventory worth because of his involvement in politics.

Now, he has referred to as for a “reside firm replace” similtaneously the discharge of Tesla’s monetary outcomes, which seems to be a determined transfer at injury management amid a tricky quarter for the corporate.

I anticipate that he’ll attempt to paint a rosy image of Tesla’s self-driving and robotic efforts to return save the corporate amid declining EV gross sales.

As I beforehand reported, I wouldn’t be shocked if he additionally pushes for Tesla to put money into his xAI startup or proposes a merger between the businesses.

Tesla may even take questions from retail shareholders primarily based on the preferred ones on Say. Listed here are the highest 5 questions and my ideas on them:

- Is Tesla nonetheless on monitor for releasing “extra inexpensive fashions” this yr? Or will you be specializing in simplified variations to reinforce affordability, just like the RWD Cybertruck?

- We have now had the reply to that query for a couple of yr now, however Tesla shareholders don’t consider it as a result of Elon claimed that Reuters’ authentic report that Tesla canceled its extra inexpensive EV was “incorrect” when it truth it wasn’t. As we not too long ago reported, Musk killed the “$25,000 Tesla” in favor of the Robotaxi and constructing new stripped-down variations of Mannequin Y and Mannequin 3.

- When will FSD unsupervised be accessible for private use on personally-owned vehicles?

- Lol – we’re simply going to get Elon’s “finest guess”, which has been incorrect each time for the final decade.

- How is Tesla positioning itself to flexibly adapt to world financial dangers within the type of tariffs, political biases, and so on.?

- Musk goes to say “you go woke, you go broke” and that his pathetic quest to “kill the woke thoughts virus” will finally be good for Tesla as a result of the world might be rid of this damaging virus. As for the worldwide financial dangers, I wouldn’t be shocked if Tesla broadcasts extra layoffs quickly.

- Robotaxi nonetheless on monitor for this yr?

- It may very effectively be. We have now already reported intimately about how Tesla’s “robotaxi” launch in Austin, deliberate for June, is definitely a “transferring of the purpose” and it has little or no to do with Tesla’s long-stated promise of delivering unsupervised self-driving in a consumer automobile, as requested within the second query.

- Did Tesla expertise any significant modifications so as influx price in Q1 referring to the entire rumors of “model injury”?

- If they are saying no right here, don’t consider them. Tesla is down 50,000 models in Q1, and sure, the Mannequin Y changeover has one thing to do with it, however you’ll be able to clearly see now, primarily based on new Mannequin Y supply timelines, that Tesla has no order backlog for the automobile. It would probably launch incentives to promote the brand-new automobile that was supposed to avoid wasting Tesla’s auto enterprise within the coming weeks.

Tune in with Electrek after market shut right now to get all the most recent information from Tesla’s earnings, convention name, and now additionally an obvious “firm replace.”

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.