There was a rising name to switch India’s taxation system, with an rising variety of monetary influencers batting for decreasing of taxes. Whereas one influencer stated turning India into the “taxation capital” of the world just isn’t the reply, one other identified how on the finish of their companies, the wage class pays extra in taxes than the financial savings they accumulate. Yet one more influencer stated that Indian taxes are one purpose why a variety of well-earning folks depart the nation.

Knowledge Hatch founder and finfluencer Akshat Shrivastava stated the financial system is dying and speaking concerning the nation’s GDP received’t assist. He prompt three issues that may be performed instantly to enhance the scenario: decreasing taxes, widening the tax base, and giving job-linked incentives to corporations.

Shrivastava stated there ought to be a direct reduce on GST and that 15 per cent ought to be the utmost slab. He prompt widening the tax base and together with BCCI and IPL, which he stated might herald Rs 6,000 crore of extra tax. He additionally stated the federal government ought to provide 0 per cent tax advantages for startups in the event that they make use of a sure variety of folks.

“Taxing folks to demise. And, making India a taxation capital of the world just isn’t the reply,” he stated.

One other influencer who has been vocal towards India’s excessive taxation stated folks pay over Rs 2.5 crore in direct and oblique taxes all through their profession, whereas their complete properties and financial savings don’t even contact Rs 1 crore. “This exposes the brutal actuality, taxpayers are squeezed dry however get virtually nothing in return. It appears the federal government believes persons are born in India solely to pay taxes and endure,” he stated.

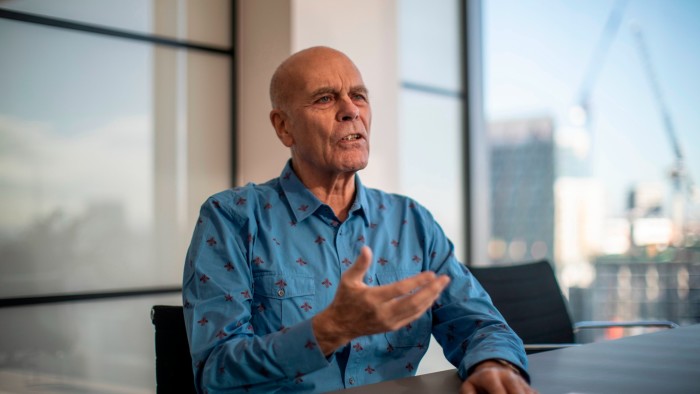

Investor and dealer Jose Paul Martin, evaluating the taxation for people and companies, stated: “There are various issues it’s essential to perceive. And one such factor is that the federal government is milking you dry as a person. You get the unhealthy finish of the stick.”

He stated people pay virtually 25 per cent of their revenue to the federal government, with out even together with GST. If as an individual incomes Rs 5 lakh, your bills are Rs 1 lakh, then you might be paying greater than that – Rs 1.3 lakh – to the federal government. “And we’ve not even factored in GST on the products & companies you pay with no matter is left over from paying the government,” he stated, including that one can be higher off beginning an organization.

Throughout the 2025 Union Funds, Finance Minister Nirmala Sitharaman introduced that there will likely be no revenue tax payable as much as an revenue of Rs 12 lakh underneath the brand new regime. “This restrict will likely be Rs.12.75 lakh for salaried tax payers, on account of normal deduction of Rs. 75,000,” she stated, including that the brand new charges will scale back taxes on center class and depart more cash of their fingers.

The tax fee construction was revised as under:

Rs 0-4 lakh – NIL

Rs 4-8 lakh – 5%

Rs 8-12 lakh – 10%

Rs 12-16 lakh – 15%

Rs 16-20 lakh – 20%

Rs 20-24 lakh – 25%

Above Rs 24 lakh – 30%