Amid rising controversy, murmurs of a possible buyout of Gensol’s EV ride-hailing subsidiary—BluSmart Mobility—are doing the rounds. Reviews recommend that impression funding agency Eversource Capital has evaluated a doable acquisition pegged at round Rs 1,000 crore. Nevertheless, the agency has declined to remark, stating that it commonly assesses enterprise alternatives as a part of customary operations.

The regulatory warmth on Gensol Engineering Ltd is intensifying by the day. After the Securities and Change Board of India (SEBI) initiated motion in opposition to the Jaggi brothers (Puneet Singh Jaggi and Anmol Singh Jaggi, promoters of Gensol) over alleged monetary misconduct, PFC (Energy Finance Company) has now filed a proper criticism with the Financial Offences Wing (EoW), alleging doc falsification within the electrical car (EV) leasing undertaking involving Gensol.

On this local weather, the potential for a BluSmart buyout has raised eyebrows.

Authorized consultants warning that any deal for BluSmart is not going to be a clear sweep. “A purchaser would inherit not simply the enterprise but additionally the luggage of a probably tainted model,” says Siddharth Chandrashekhar, Advocate & Counsel at Bombay Excessive Courtroom and senior panel counsel for CBIC & DRI.

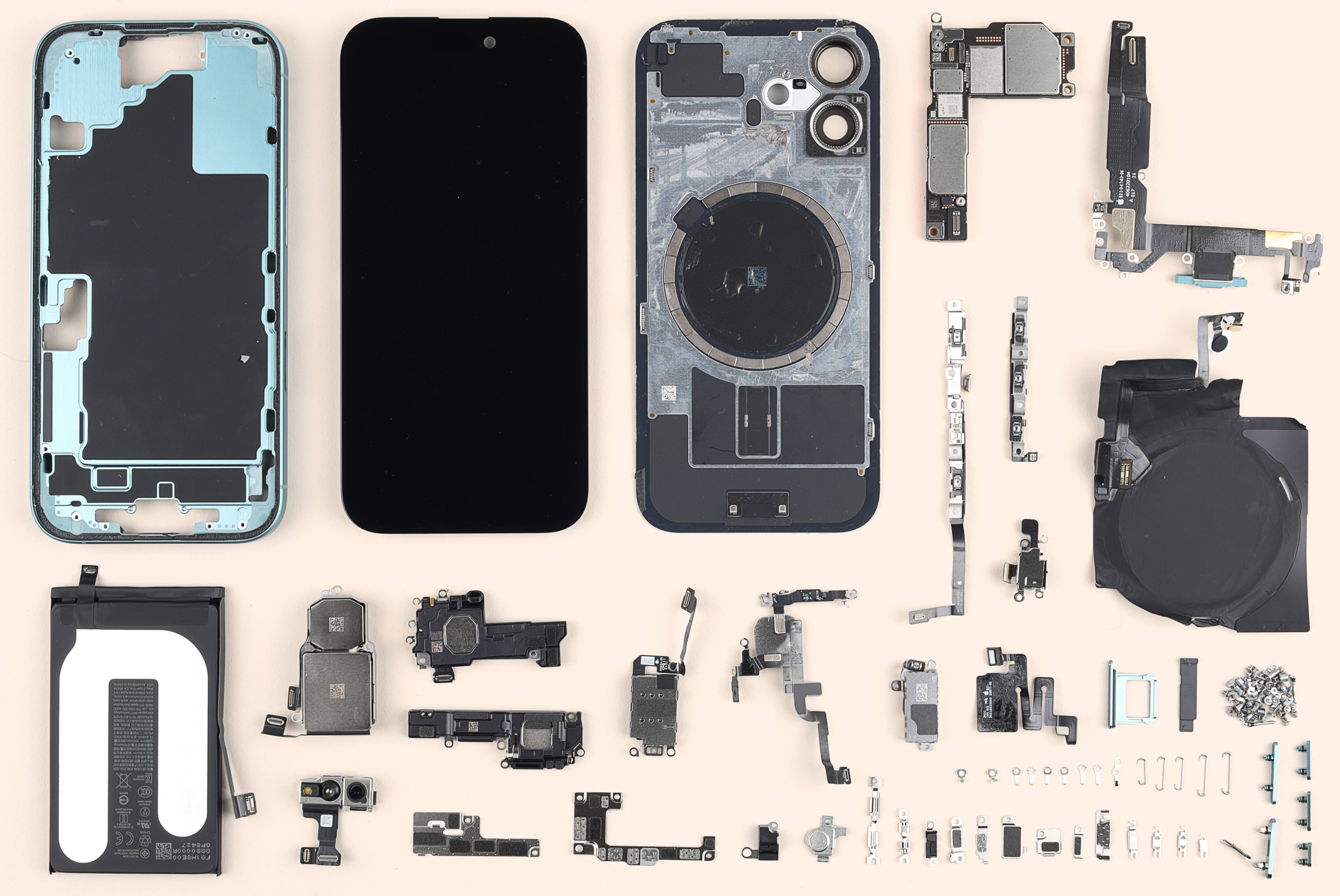

The construction of the enterprise poses one other hurdle. BluSmart’s EV fleet is leased from its guardian Gensol and never owned immediately. That provides complexity to any asset buy or enterprise switch, with potential authorized and monetary liabilities within the combine.

“SEBI is but to provoke a forensic audit into Gensol and its associated entities, together with BluSmart,” says Vaibhav Kakkar, Senior Accomplice at Saraf and Companions. “Any opposed findings will additional complicate a buyout. Till there’s readability from SEBI’s facet, severe patrons might stay cautious.”

From a authorized standpoint, any acquisition would require thorough due diligence and contractual safeguards. “Representations, warranties, and indemnities could be important to defend the acquirer from previous liabilities tied to Gensol,” Chandrashekhar provides. He additionally factors to the crucial want for compliance with Part 188 of the Firms Act, 2013 and SEBI’s LODR Regulation 23, each of which take care of related-party transactions and audit oversight.

Whereas BluSmart has constructed a repute as a buyer favorite in India’s EV mobility house, the worsening state of affairs at Gensol might derail any simple takeover—no less than for now.