Germany-headquartered stay occasions and ticketing firm DEAG has reported an 18% YoY improve in income for 2024.

In an earnings report issued on Friday (April 25), DEAG mentioned it had reached revenues of “roughly” EUR €370 million (USD $400.4 million on the common trade fee for 2024) in 2024, up from €313.5 million in 2023.

The corporate bought round 11 million tickets in 2024, up round 10% from the yr earlier than, and forecast it could promote round 12 million in 2025.

DEAG mentioned that, as of the discharge of the earnings report, it had already bought round 4 million tickets for occasions to be held in 2025. It was the second yr in a row that the corporate achieved report advance ticket gross sales.

A “regular and strongly rising share” of tickets to DEAG’s occasions are coming from its personal ticketing platforms, the corporate mentioned. These platforms embody myticket.de, myticket.at, myticket.co.uk, gigantic.com and tickets.ie.

The Reside Touring phase, which incorporates DEAG’s subsidiary ticketing firms, noticed revenues leap 20.2% YoY to €206.8 million ($223.8 million), whereas the Leisure Companies division noticed a 39.3% YoY leap in income to €185.2 million ($200.4 million).

Nonetheless, DEAG posted an working lack of -€2.4 million (-$2.6 million) in 2024, in comparison with an working revenue of €13.3 million the yr earlier than. EBITDA noticed a 45% YoY drop to €14.4 million ($15.6 million), which the corporate mentioned was attributable to a “acutely aware and strategic” choice to divert capital in the direction of tasks that can guarantee long-term progress.

Amongst these are a digitization initiative and expenses related to a restructuring of the Govt Board. Final yr noticed the departure of DEAG Co-Founder Peter L.H. Schwenkow from the function of Chairman of the Govt Board, whereas Wolf-Dieter Gramatke stepped down as Chairman of the Supervisory Board. Moreover, DEAG confronted further bills from “weather-related challenges” to open-air occasions in Europe, the corporate mentioned.

DEAG says its EBITDA margin, which was 4% in 2024, will “improve considerably” this yr.

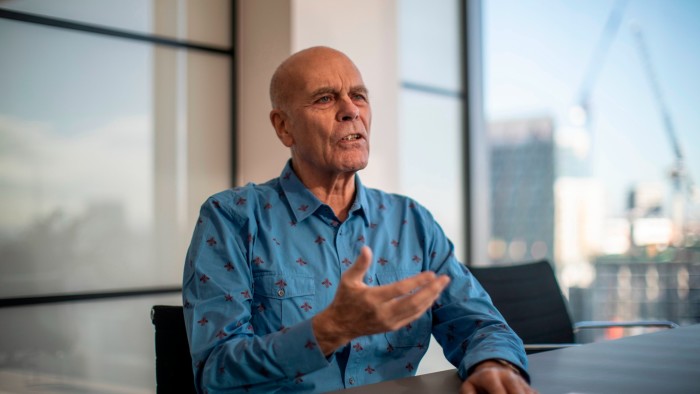

“We consciously invested in these strategic measures, regardless of the appreciable bills concerned, which briefly led to a decline in earnings,” Group CEO Detlef Kornett wrote in a be aware to buyers.

“We’ve constantly applied our progress technique and made a acutely aware choice in 2024 to make above-average investments in our sustainable enterprise improvement with a view to safe our future and place ourselves in the absolute best manner,” Kornett added in a press release.

“Successes are already seen. We began the present yr with tailwind and our ticket gross sales are at report ranges. Our occasion pipeline is excellently stuffed and we count on 2025 to be a a lot stronger yr with a major improve in profitability.”

The corporate continued its “Purchase & Construct” technique in 2024, coming into the Italian market with the full acquisition of occasion organizer MC² Reside and a majority stake in Germany’s black mamba Occasion & Advertising and marketing GmbH.

DEAG additionally expanded its function within the UK – the corporate’s second-biggest market after Germany – with the acquisition of How To Academy and stay leisure organizer ShowPlanr. The How To Academy acquisition additionally strengthened DEAG’s Spoken Phrase & Literary Occasions phase, which the corporate notes now accounts for 10% of its income, three years after its launch.

The corporate additionally goals to extend the share of income coming from its personal occasions. To that finish, it just lately launched EDM festivals SPUTNIK SPRING BREAK and Gestort, aber Geil….

“That is serving to to make sure that a rising variety of tickets are bought through the Group’s personal ticketing platforms,” Kornett wrote.

“We consciously invested in these strategic measures, regardless of the appreciable bills concerned, which briefly led to a decline in earnings.”

Detlef Kornett, DEAG Group

The corporate concurrently launched its This autumn 2024 earnings, exhibiting a 17% YoY improve in income to €117 million ($124.7 million on the common trade fee for the quarter).

“The final three months of the monetary yr had been characterised by robust Christmas enterprise and excessive advance gross sales for stay occasions in 2025,” DEAG mentioned in a press release.

In January of 2024, DEAG introduced its intention to listing on the Frankfurt inventory trade, having delisted in 2021 as a result of “huge adverse influence” of the Covid pandemic on stay occasions. Nonetheless, the corporate introduced the next month that it was delaying the transfer to a “later date.”

The newest earnings report didn’t present an replace on DEAG’s relisting plans.Music Enterprise Worldwide