Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

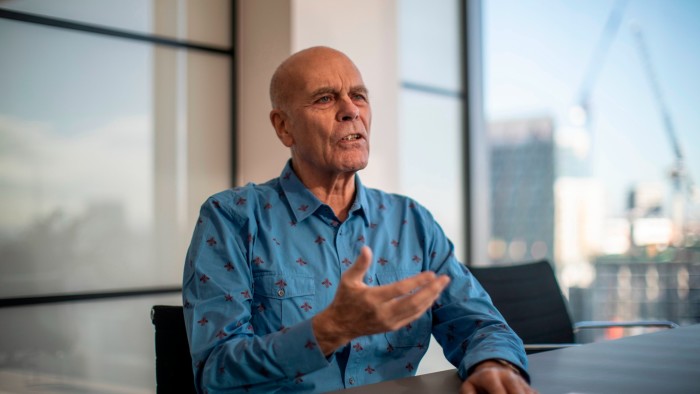

Peter Harf, chair and managing associate of Europe’s JAB Holdings, is retiring after greater than 40 years, because the funding group he created diversifies away from its troubled consumer-focused portfolio.

The 78-year-old German government can be succeeded by managing companions and co-chief executives Joachim Creus and Frank Engelen, JAB introduced on Monday. Creus will change into chair and Engelen will function vice-chair.

Harf’s retirement ends a four-decade run through which he turned one in all Europe’s strongest dealmakers, turning the heirs of the reclusive Reimann household into billionaires within the course of.

He’s credited with remodeling an obscure German chemical compounds firm, managed by the Reimanns, into a strong conglomerate proudly owning main stakes in a few of the world’s largest shopper manufacturers, together with Keurig Dr Pepper, Pret A Manger, Krispy Kreme and JDE Peet’s.

Alongside working the Reimann household’s wealth, together with its investments in shopper manufacturers, JAB’s companions raised capital from different rich households and endowments, to fund a dealmaking spree in extra of $50bn.

Nonetheless, JAB’s over-reliance on shopper manufacturers was badly uncovered by dramatic adjustments in behaviour through the pandemic, and by the next inflationary surge, which squeezed spending energy.

The group not too long ago reported the worth of its portfolio was slashed by $10.1bn final yr, as its investments in espresso, bakeries and sweetness have been marked down dramatically. In whole, the truthful worth of JAB’s investments in its numerous subsidiaries tumbled 24 per cent to $39bn.

JAB beforehand stated it was assured the robust operational efficiency of its portfolio would end in a re-rating of its valuation within the medium to long-term.

JAB is diversifying aggressively into life insurance coverage and asset administration seeking extra dependable revenue streams. A spokesperson for the Reimann household stated Creus and Engelen had “set forth a compelling strategic imaginative and prescient to organize JAB for the following technology of sustainable long-term progress”.

The spokesperson added the pair had prior to now yr launched the agency’s new life insurance coverage division and made its first acquisition within the sector. The deal for Prosperity Life, which manages $25bn of belongings, valued the insurer at greater than $3bn.

Regardless of its new focus, JAB continues to carry important stakes in shopper corporations, together with magnificence group Coty and Panera Manufacturers, which owns bakeries and occasional retailers.

The corporate on Monday stated Harf will stay “totally invested” within the agency and proceed to function chair of the Reimann household’s non-profit organisation, the Alfred Landecker Basis.

“I wish to categorical my gratitude to the Reimann household who, greater than 40 years in the past, entrusted me to embark on the journey of a lifetime,” Harf stated. “It’s now time to cross the baton to a brand new technology of management.”