IndusInd Financial institution has disclosed the findings of an unbiased investigation into accounting discrepancies first revealed in March. The report factors to severe lapses, quantifying a ₹1,959.98 crore impression on the financial institution’s earnings, because the management strikes swiftly to repair accountability and overhaul inner controls.

IndusInd Financial institution, by way of an official disclosure to inventory exchanges on April 27, confirmed that an unbiased skilled agency, appointed by its Board of Administrators, submitted its investigative report on April 26. The agency’s report validated the cumulative adversarial accounting impression of ₹1,959.98 crore on the financial institution’s Revenue and Loss account as of March 31, 2025, carefully aligning with the determine earlier disclosed on April 15.

“The unbiased agency has decided a cumulative adversarial accounting impression on P&L at Rs 1959.98 crores as on 31 March 2025, which has similarities to the quantity disclosed on fifteenth April 2025,” IndusInd Financial institution mentioned in a regulatory submitting.

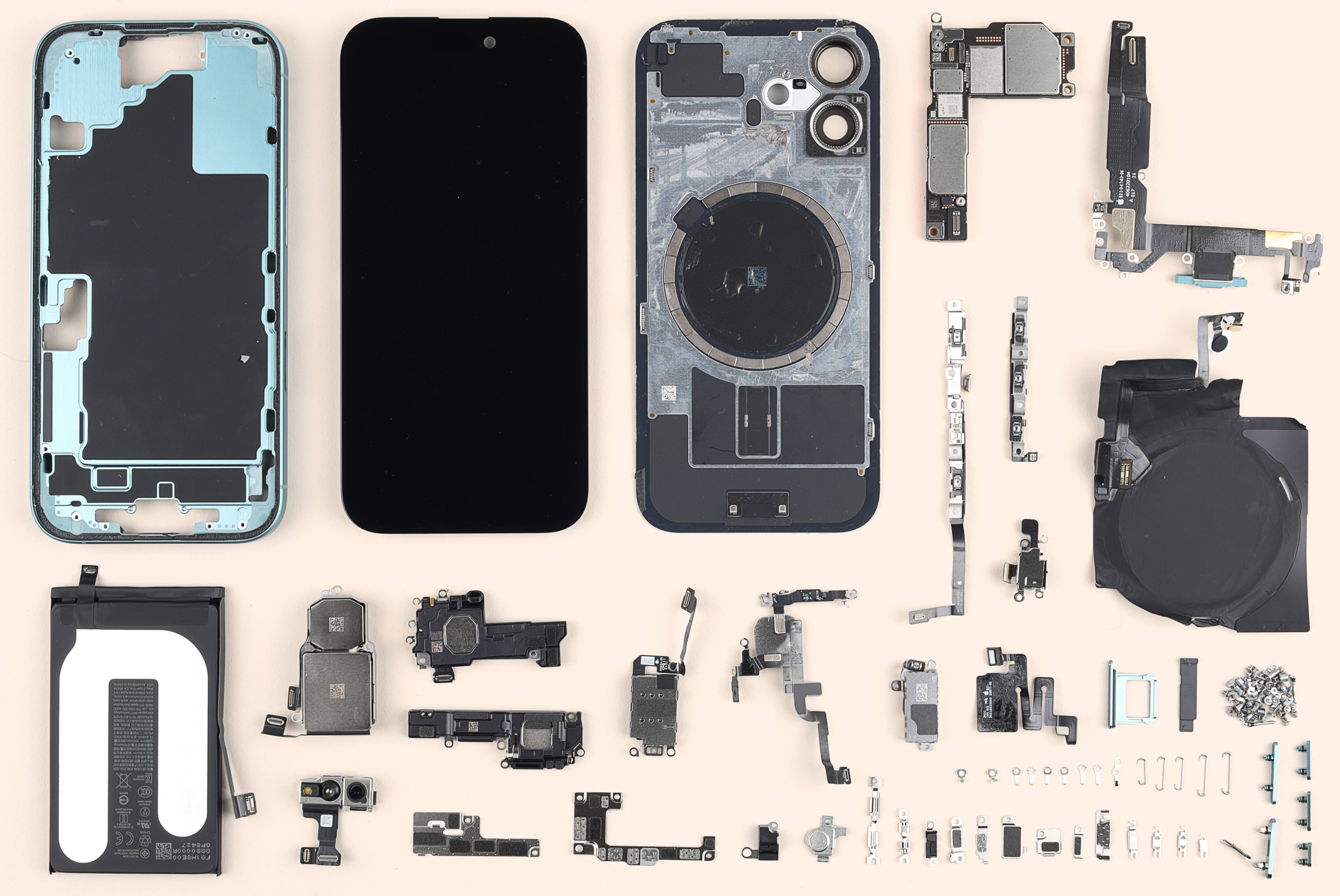

Based on the report, the discrepancies had been primarily stemmed from the inaccurate accounting of inner by-product trades particularly throughout early terminations. These practices led to the untimely recognition of notional earnings, marking the principal root explanation for the monetary misstatements. It additionally evaluated the roles and actions of key workers concerned.

“The Board is taking vital steps to repair accountability of the individuals liable for these lapses and re-align roles and duties of senior administration,” the financial institution knowledgeable the bourses.

IndusInd Financial institution has already discontinued all inner by-product buying and selling actions from April 1, 2024. Moreover, the resultant monetary impression will likely be duly mirrored within the financial institution’s FY24-25 monetary statements, alongside measures to fortify inner controls.

The board conferences discussing the report commenced at 8:42 pm on April 26, adjourned previous midnight, and reconvened on April 27, concluding discussions by 6:25 pm. The disclosure can be accessible on the financial institution’s web site, www.indusind.com. The financial institution has urged regulators and traders to pay attention to the developments.

—

### 5 Headline Choices

1. **IndusInd Financial institution flags ₹1,959.98 crore hit after inner audit finds accounting lapses**

2. **₹1,959.98 crore impression: IndusInd Financial institution identifies root trigger behind accounting discrepancies**

3. **After ₹1,959.98 crore jolt, IndusInd Financial institution strikes to repair lapses in inner controls**

4. **Inner derivatives gone unsuitable: IndusInd Financial institution faces ₹1,959.98 crore accounting setback**

5. **IndusInd Financial institution uncovers ₹1,959.98 crore discrepancy, pledges accountability and reforms**