Sprawling, power-thirsty knowledge facilities have develop into as a lot a staple of suburbia in some locations as buying malls and soccer fields. Nonetheless, when Microsoft pulled the plug on deliberate knowledge facilities in Ohio final month, it added to questions on whether or not the nascent knowledge heart increase had already gone bust. A Wells Fargo report final Monday saying some knowledge facilities deliberate by Amazon Internet Companies have been being reconsidered added to market anxiousness.

However the bust could have been over earlier than it ever started. And if something, a “pause” on some knowledge heart initiatives comes inside a spending setting that continues to be robust.

“We proceed to see accelerated scaling of AI deployments throughout the info heart market, with robust demand indicators reinforcing each our near- and long-term development,” stated Giordano Albertazzi, CEO of Ohio-based knowledge heart provider Vertiv on an earnings name final week. Its shared ended the week up 22%.

Amazon and Nvidia each reaffirmed final week that the info heart market stays robust.

“There’s been actually no vital change,” Kevin Miller, Amazon’s vp of world knowledge facilities, stated at a convention organized by the Hamm Institute for American Vitality. “We proceed to see very robust demand, and we’re trying each within the subsequent couple years in addition to long run and seeing the numbers solely going up.”

That does not imply the strategic occupied with how, the place and when precisely to spend is not altering because the AI market evolves and breakthroughs must be digested. Within the span of six weeks this 12 months, China’s DeepSeek burst onto the scene, President Trump’s $500 billion AI-powered Stargate initiative was introduced, and considerations over tariffs and commerce wars roiled markets.

“All of that has created a state of affairs the place the info heart business is taking a little bit of a pause, broadly,” stated Pat Lynch, government managing director for business actual property firm CBRE’s Information Middle Options. “I believe it’s a momentary pause,” Lynch added, noting that the undertaking pipeline and its funnel stay vital and CBRE continues to execute offers. “I stay cautiously optimistic about future demand, notably once you consider massive AI coaching fashions,” Lynch stated.

Microsoft had pledged a $1 billion funding in Ohio-based knowledge facilities in the identical space the place Intel has deliberate chip factories, however the timeline has slowed.

“After cautious consideration, we is not going to be shifting ahead with our plans to construct knowledge facilities on the Licking County websites right now. We’ll proceed to judge these websites in step with our funding technique,” a Microsoft spokesperson stated in an announcement to CNBC.

A UBS report from final week concluded that amongst all of the doable explanations for knowledge heart cancellations, it was most probably that Microsoft had overcommitted amid the AI rush, and was now zeroing in on the initiatives that at the moment take advantage of sense. It famous that Microsoft’s leased capex was up 6.7x within the span of two years, with lease obligations of roughly $175 billion. “Microsoft purchased up as a lot obtainable leased knowledge heart capability because it may in 2022-2024 and now has the visibility to get rid of a few of these ‘early-stage initiatives,'” UBS wrote. “We discover the least help for the ‘demand lull’ clarification,” its report added.

Anat Ashkenazi, Alphabet CFO, described the cloud supply-demand setting as “tight” after its newest earnings on Thursday. “We may see variability in cloud income development charges relying on capability deployment every quarter,” she stated. “We anticipate comparatively greater capability deployment in the direction of the top of 2025.”

“We’re not seeing a retreat from demand however a strategic reallocation,” stated John Carrafiell, co-CEO of BGO, a worldwide actual property funding supervisor with $83 billion in belongings underneath administration, together with a major knowledge heart portfolio. Essentially the most vital gamers, he says, aren’t pulling again, with Microsoft, Google, Meta, and Amazon planning to spend over $300 billion in capex this year-largely tied to AI infrastructure. And, he says, that does not embody different main gamers, reminiscent of OpenAI and Oracle, each concerned within the Stargate undertaking.

“Moderately than a bust, it is a reshuffling of the deck in an setting the place energy specifically, together with fiber, water, and land — are scarce and strategic,” Carrafiell stated. Lengthy-term enterprise adoption will drive AI demand and knowledge heart demand for the following decade. “We aren’t even within the first inning but,” he stated.

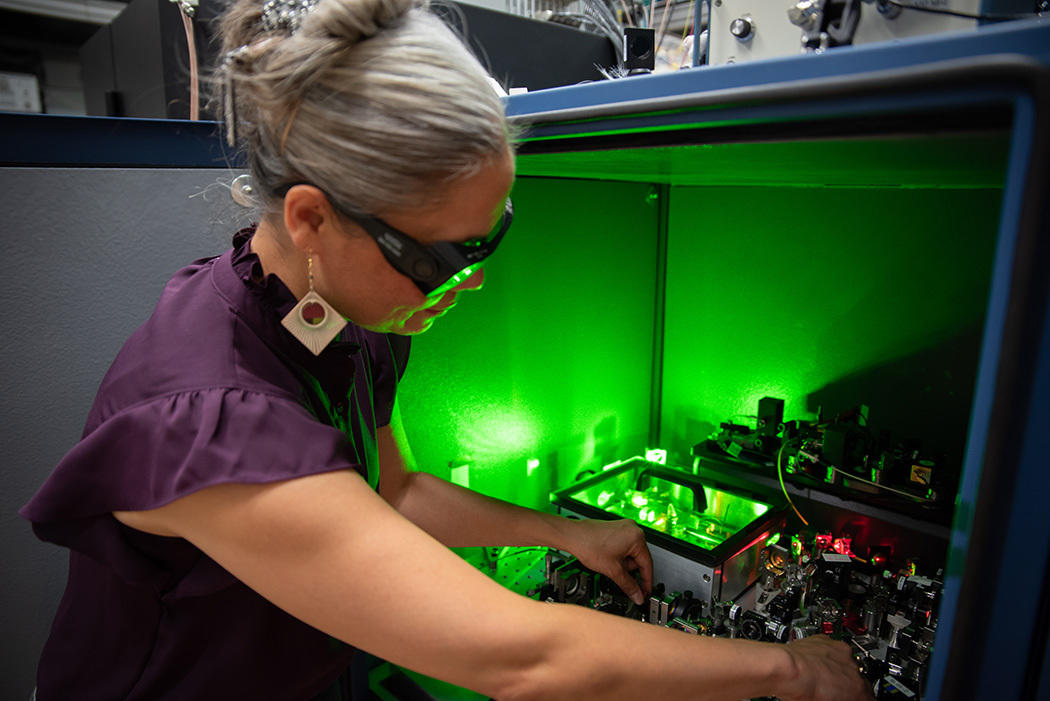

Energy is the lifeblood of information facilities, however knowledge facilities aren’t plug-and-play operations, requiring copious quantities of electrical energy for computing energy and followers to maintain the infrastructure cool. As generative AI adoption strikes from early experimentation to enterprise-scale utility, the necessity for low-latency, high-efficiency knowledge facilities close to end-users will intensify, however it would take time for the precise set of circumstances to line up with the anticipated knowledge heart sq. footage.

“New knowledge facilities are growing in dimension so dramatically that the grid can’t sustain,” stated Allan Schurr, chief business officer of microgrid developer Enchanted Rock. Three years in the past, a big knowledge heart was 60 megawatts — sufficient energy to provide 20,000 houses, however now he says new knowledge facilities to help all of the makes use of of synthetic intelligence are requesting 500 megawatts or extra.

This fast development in electrical energy use is on high of recent demand from manufacturing and the electrification of transportation, which collectively are weighing on provide and infrastructure. Information facilities pose a novel problem to utilities, which should guarantee they’ll provide energy to all clients, even in instances of peak demand. “For this reason some utilities are quoting lengthy interconnection wait instances for knowledge facilities,” Schurr stated. “Utilities must put money into new substations and may additionally must broaden transmission and technology, all of which takes time,” he added.

CBRE has seen knowledge facilities go from comprising 2% of its portfolio in 2022 to 10% in 2024, and Lynch expects that to continue to grow, and energy proximity is driving the present market, as knowledge heart builders search areas with entry to plentiful energy. Georgia, Texas, and Ohio all examine plenty of the containers builders are on the lookout for, and if an space would not have the grid or infrastructure capability, it wants to have the ability to scale up quick.

“Having massive energy availability inside 36 months is enticing to shoppers,” Lynch stated.

Three % of the world’s energy is now tied up in knowledge facilities, based on Datacenters.com.

Schurr stated Enchanted Rock’s knowledge signifies there’s loads of energy obtainable to satisfy demand — more often than not. Of the 8,760 hours of the 12 months, the grid is barely underneath stress for a fraction of them. “If we are able to alleviate demand on the grid for these 100 to 500 hours, the lengthy interconnection delays may be shortened,” he stated.

There is a vital distinction to be made between the thought of a broader slowdown and among the current pauses enacted by main expertise firms, based on McKinsey & Firm senior associate Pankaj Sachdeva, who researches knowledge heart growth and expects an ebb and circulation.

Based mostly on current McKinsey modeling, which doesn’t embody tariffs affect, the info heart market is anticipated to develop within the 20%–25% vary over the following 5 to seven years, however 12 months to 12 months there might be variations within the development fee. “It is not going to be linear,” he stated.

Tariff modifications will introduce new value pressures throughout AI and knowledge heart provide chains, notably with essential mineral tariffs on the horizon.

“These disruptions will elevate {hardware} prices, affect sourcing methods, and require companies to rethink their long-term procurement fashions,” stated John Archer, senior supply principal and provide chain transformation Chief at Slalom Consulting. Within the quick time period, AI and cloud suppliers might want to implement cost-mitigation methods reminiscent of renegotiating provider contracts and optimizing stock.

“Longer-term, a push in the direction of geographic diversification, co-manufacturing in tariff-friendly areas, and deeper integration of AI-driven provide chain analytics may be anticipated to adapt to evolving commerce insurance policies,” Archer stated.

One issue that hasn’t modified is that compute energy is at the moment costly, and rather more of it’s wanted for AI software program and {hardware}, based on Suresh Venkatesan, CEO of POET Applied sciences, a publicly-traded firm that develops energy options for knowledge facilities. “The explosion in AI challenges knowledge facilities to search out extra environment friendly options as a result of AI requires compute energy in such quantity that it is in contrast to something we now have ever witnessed,” he stated. “Whereas one knowledge heart undertaking could hit a wall, others are more likely to spring up, as a result of there isn’t a indication of a slowdown in demand for connectivity,” he added.