We not too long ago printed an inventory of 12 Greatest Uranium Shares to Put money into Based on Analysts. On this article, we’re going to check out the place BWX Applied sciences, Inc. (NYSE:BWXT) stands in opposition to different uranium shares to put money into.

Nuclear energy is making a notable comeback. Greater than 20 international locations pledged to triple nuclear power by 2050 on the COP28 summit. Nuclear energy is taken into account essential for decreasing emissions, and it’s gaining assist from each environmental advocates and US nationwide safety pursuits, although for various motivations. Massive tech firms are additionally getting concerned as they hunt for extra power to energy huge information facilities.

Uranium just isn’t presently categorized as a “crucial mineral” by the US Geological Survey (USGS) as a result of it’s categorised as a gasoline mineral. Nevertheless, President Trump is pushing for its inclusion within the checklist, which might collect federal assist and pace up venture approvals. This looks as if a wise play on Trump’s half, as demand for uranium is climbing, and the US depends nearly completely on imports, with a lot of the world’s provide originating from a handful of nations. Uranium costs had been at a 16-year excessive in 2023 and, whereas they’ve dipped marginally, they continue to be increased than at any time since Fukushima in 2011.

In December 2024, John Ciampaglia, CEO of Sprott Asset Administration, informed CNBC that the uranium business had been on life assist for almost a decade after Fukushima, and there wanted to be higher provide self-discipline out there. Uranium producers want to make sure that future provide matches demand. He famous that three components supported the business – first, the rising electrification in China, India, and different growing international locations, secondly, power safety and decarbonization are placing the main focus again on nuclear gasoline as an power supply, and third, tech firms are actually investing within the improvement of small modular reactors. He additionally commented on uranium spot and market costs, that are steadily shifting upward. He believes uranium costs have to go increased to incentivize chemical producers and miners to extend manufacturing and construct new mines, which is crucial to growing uranium as a dependable electrical energy gasoline within the coming many years.

Present provide shortages, increased long-term costs, and forecasts for document nuclear power manufacturing in 2025 all level to a constructive future. With that business outlook in thoughts, let’s check out the most effective uranium shares to purchase in keeping with analysts.

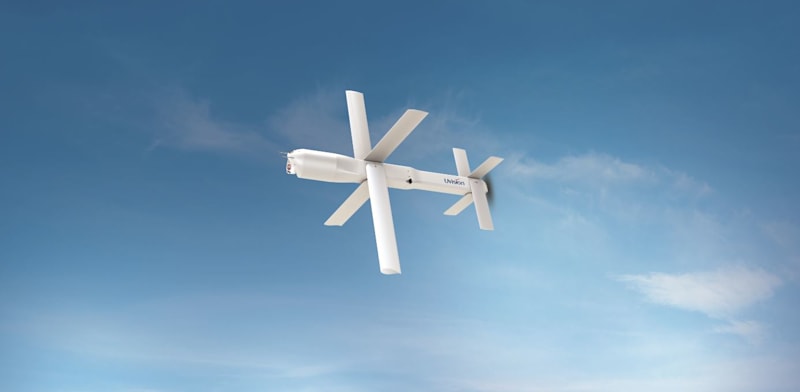

An aerial view of a nuclear plant, its domes casting a singular shadow.

For this text, we searched credible web sites and compiled an in depth checklist of US-listed uranium shares. Subsequent, we manually looked for the common upside potential of every inventory and chosen 12 shares with the best values. The checklist under is ranked in ascending order of the upside potential as of April 19. Now we have additionally talked about the hedge fund sentiment as of This fall 2024.