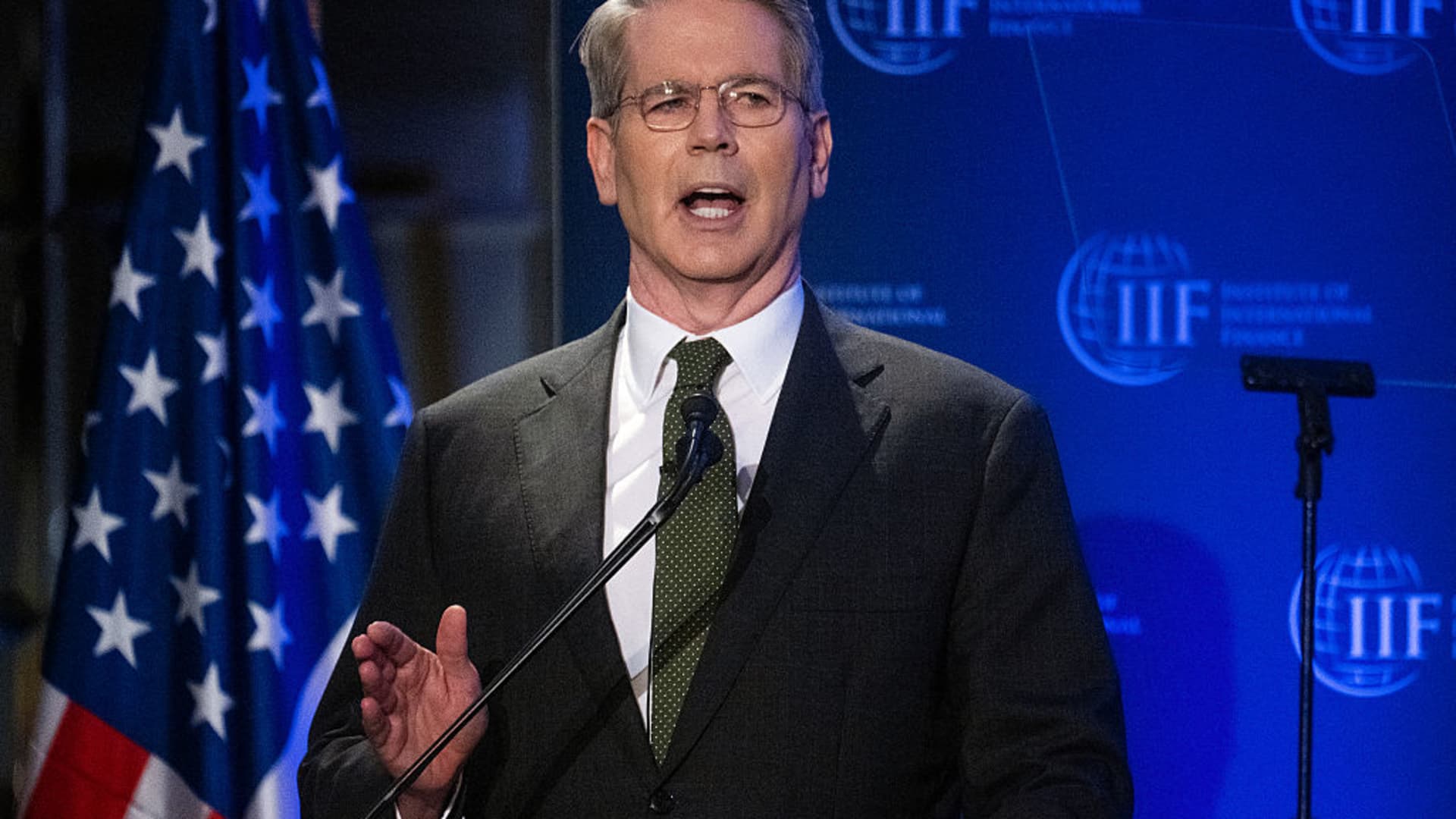

US Treasury Secretary Scott Bessent speaks throughout the Institute of Worldwide Finance (IIF) World Outlook Discussion board in Washington, DC on April 23, 2025.

Jim Watson | Afp | Getty Pictures

Treasury Secretary Scott Bessent on Wednesday mentioned “there is a chance for a giant deal right here” on commerce points between the US and China.

“In the event that they wish to rebalance, let’s do it collectively,” Bessent mentioned throughout an look on the Institute of Worldwide Finance in Washington, D.C.

“That is an unbelievable alternative. I feel if Bridgewater founder Ray Dalio had been to jot down one thing, he might name it a lovely rebalancing.”

Dalio, on April 13, informed NBC Information that he was nervous that President Donald Trump‘s tariff and financial insurance policies would threaten the world’s financial system, probably to the purpose of “one thing worse than a recession.”

Trump has imposed ultra-high tariffs on China, of 145%. Shortly earlier than Bessent spoke on Wednesday, The Wall Avenue Journal reported that the Trump administration was contemplating lowering these tariffs to between 50% and 65%, which might nonetheless be extraordinarily excessive, comparatively talking.

Bessent, in his tackle to the IIF, outlined what he known as “a blueprint to revive equilibrium to the worldwide monetary system and the establishments designed to uphold it,” particularly the World Financial institution and Worldwide Financial Fund.

“The IMF and World Financial institution have enduring worth,” Bessent mentioned. “However mission creep has knocked these establishments off track. We should enact key reforms to make sure the Bretton Woods establishments are serving their stakeholders — not the opposite means round.”

He mentioned that “Intentional coverage selections by different nations have hollowed out America’s manufacturing sector and undermined our essential provide chains, placing our nationwide and financial safety in danger.

“President Trump has taken sturdy motion to handle these imbalances and the unfavorable impacts they’ve on People.

“This established order of enormous and protracted imbalances shouldn’t be sustainable. It isn’t sustainable for the US, and in the end, it’s not sustainable for different economies.”

Bessent known as out the World Financial institution for lending to nations which have superior financial development, together with China.

He prompt that the financial institution cease lending to China.

“The World Financial institution continues to lend yearly to nations which have met the factors to graduate from World Financial institution borrowing,” Bessent mentioned.

“There isn’t any justification for this continued lending. It siphons off sources from larger priorities and crowds out the event of personal markets. It additionally disincentivizes nations’ efforts to maneuver away from dependency on the World Financial institution and towards job-rich, personal sector-led development.”

Bessent added: “Going ahead, the Financial institution should set agency commencement timelines for nations which have lengthy since met the commencement standards. Treating China — the second-largest financial system on this planet — as a ‘creating nation’ is absurd.

“Whereas it has been on the expense of many Western markets, China’s rise has been fast and spectacular,” he mentioned. “If China desires to play a job within the world financial system commensurate with its precise significance, then the nation must graduate up, we welcome that.”

— CNBC’s Erin Doherty contributed to this story.